Quantamental — A Convergence Of Intelligence

In the previous article, “What is Quantamental Investing®?” we discussed that all three schools of investment analysis i.e. Fundamental, Quantitative and Technical are converging on to the use of machines and data. Significant advances are being made in the field of machine learning (in both algorithms and hardware) which have led to the discovery of new sources of Alpha.

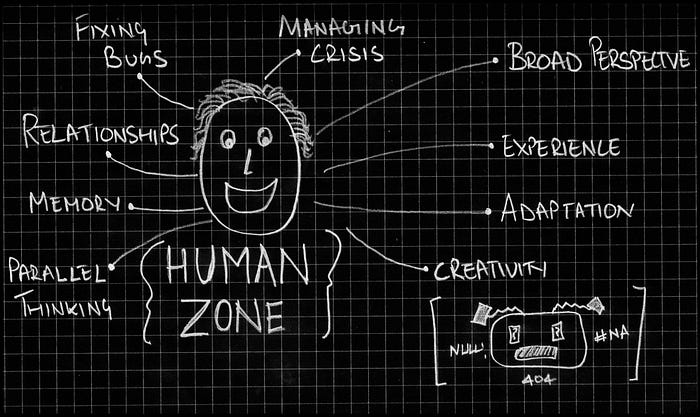

However, human insights still play an irreplaceable role in providing context to the analysis made by machines. Humans point out where to look, machines do the math.

Quantamental Investing® acknowledges that both, machines and men are essential in making good investing decisions. It understands that neither’s capability is superior to the other’s, nor does each make the other redundant. Each capability has its own strengths which complement the other’s weaknesses. Let’s explore how by understanding both.

Machines — The Raw Power of Discovering Insights

Machines in investing are algorithms (running on hardware) that perform a narrow or broad scope of tasks. The use of algorithms in markets can be broadly classified into three categories in order of increasing complexity:

- Execution

- Automation

- Decision making

Execution Algorithms

The first category of algorithms has a limited role in investing and pertains more to trading. The primary advantage of machine-based execution is its lightning-fast speed (in microseconds). Execution algorithms are a replacement for specialist traders who could punch in multi-leg orders (an order which has multiple buy and/or sell instructions executed at the same time) and are available for anyone who can build them.

Unsurprisingly, today’s execution traders typically hold a computer science degree.

High-speed trading is now reduced to lines of code in Python and C++.

High-speed trading strategies when executed continuously can act as an investment product with many different characteristics than plain vanilla long-only products. For example, an arbitrage fund that goes long and short in stocks and futures at the same time has much different return characteristics than an index fund (which is long only).

Automation Algorithms

The second category is where the obvious advantage of the machine comes into play — running error-free, repetitive sequences. Machines do not get tired, bored of repetitions, or have mood swings or bias in their assessment of a situation. They can do the same thing day in and day out.

For example, a spreadsheet can calculate the daily returns of stock in just a few keystrokes, and organize these returns as a distribution with another few clicks. This task can be performed by humans too, but it would take them a lot of time and may cause a lot of errors in the process. In fact, a machine calculating such returns would be very inexpensive in comparison to a person.

The process of automation however, is likely to be designed by a team of humans only.

Machines are only capable of design in a limited scope.

Decision Algorithms

The third area that machines have entered recently is making investment decisions. While machines still lack the creativity of the human mind, they somewhat compensate it by brute processing power to find hidden patterns in data. They can then assign probabilities and form rules around these patterns and make decisions that are often counter-intuitive to humans’ minds.

Further, machines can try different permutations and combinations of these rules and get surprisingly different (and sometimes better) results. Machines do provide the much-needed diversification in return characteristics through alternate strategies.

The adage “You can either hold the data or the principles” simply does not apply to machines.

Machines can hold both large amounts of data and unlimited number of principles in their memories.

Though the process does require the initial handholding of humans who program these principles.

Alternative Data

Today’s investors are also using Alternative Data (which by definition, excludes rather than includes). Any data such as internet traffic on an e-tailer’s website, cars parked in the parking lot of a retailer, or even the number of flights across Europe can be used as input. The amount of raw data available is huge (hence it is called Big Data). Data is available for anything that an investor can imagine and more is being generated as you read this article.

A lot of data means a lot of processing power is required in parallel to consume and digest data. This is something the 20-watt, billion-neuron brain lacks but makes up for elsewhere.

Humans — The Ability to Draw Context.

Human brains are designed for general intelligence. The same brains (even though it uses different parts) help us walk, talk, enjoy a movie and solve a quadratic equation (with a few variables only). This makes the brain complex, energy-consuming, and consequently slower than machines. However, our brains have evolved to adapt to new situations, remember odd things, be creative, manage people, and more. These are capabilities that are still going to be beyond the scope of the machines for a long time.

Memory & Association

New situations are abundant in investing. New companies belonging to novel sectors, engaged in a variety of businesses, keep coming up with each market cycle (the time between a bear market and another bear market). Such businesses may not be linked to the businesses that thrived in the previous market cycle.

Whenever the human brain sees something new, it mysteriously accesses its memory bank, draws an association, and retrieves some relevant information. For example, the rise in valuation of digital assets in the 2020s with a something-coin as their name can easily be associated with the dot-com bubble of the 2000s (when anything with a .com after its name shot up in valuation). Even though these bubbles are two decades apart, human memory can easily associate them.

Association of events decades apart happens because human beings live in a system that is governed by the same set of slowly changing principles. These principles only change over many generations.

Note-worthily, the relationship of these businesses to human life and their implications, are best understood by human brains only.

Experience

Human history repeats itself in cycles longer than the average human life. For example, pandemics and wars keep happening over human history, but someone who was born and expired between two wars or two pandemics never gets to know about either.

Financial market cycles are however shorter. They happen 2 to 5 times within a single human’s investing career (Warren Buffet has undergone many many market cycles to be as wise and wealthy as he is today). Yet, financial memories are wiped clean because many investors do not survive a market crisis. Anyone who survived the last market cycle, usually knows how the next one will turn out. That is why experience is considered important in investing.

Experience results in applying solutions which have worked before and can be adapted to the new situation.

For humans, experience comes by default. For machines, this advance is recent and comes by design (unsurprisingly created by experienced humans in the field). Machines are coming to a point where they can learn specific things but within a limited scope only.

Fixing Bugs

Errors in execution by machines are also fixed by people. Machines at times get stuck in loops or stray down the wrong path of analysis. Only human inputs nudge them in the right direction.

Finding and fixing bugs in the thinking of machines is still a task humans perform because it requires imagination especially when the solution is not evident.

Wetware (or human brains) also excels in managing situations when a lot of things fall out of place at the same time i.e. crisis. The broad perspective of the human brain comes into use here. Machines are not able to do this for now.

Relationships

An area exclusive to humans is relationships. Building relationships in investing brings about insights that no database can give. For example, an analyst’s 15-minute phone conversation with a company’s CEO, or a General Partner’s coffee chat with a startup founder yield insights about a business’s plans that no amount of data can match.

Quantamental Investing® is a space where the capabilities of man and machine complement each other rather than compete. The job of the quantamental investor is to generate alpha while lowering risk and meeting the investment objectives. It takes both men and machines to realize this.

NEXT: Understand which analyses and what faculties are useful in constructing quantamental portfolios.